What Percentage of Your Budget Should Go to Housing

Conquer your student debt. Refinance at present.

Become My Charge per unit

This is role three of an ongoing series about housing costs. Bank check out part ane and 2 on our blog.

Are you lot searching for a place to rent? Shopping for a new apartment (or commencement apartment) can exist stressful – finding a good location with public transportation, hoping for the amenities that yous want, and striking a deal on a place before anyone else does. This stress tin be exacerbated in competitive real estate markets like New York that can cause you to jump on something that may non actually fit your financial goals. And so how do you lot go about starting the apartment search? First, sympathise what you can afford.

What is the 30% Rule?

Always heard of the xxx% dominion? It's the idea that y'all should budget a minimum of 30% of your income for housing costs, and it's practically personal finance gospel.

Affordability calculators often utilise it as a default supposition to make up one's mind how much house yous can afford; mortgage lenders have adopted it as a qualification ratio when approval yous for a loan, and private landlords oftentimes crave tenants' annual salaries to be at least three times the monthly rent.

But who exactly is post-obit this rule? And does information technology brand adept financial sense to practise then?

Practice Earnest Clients Spend Above the xxx% Rule?

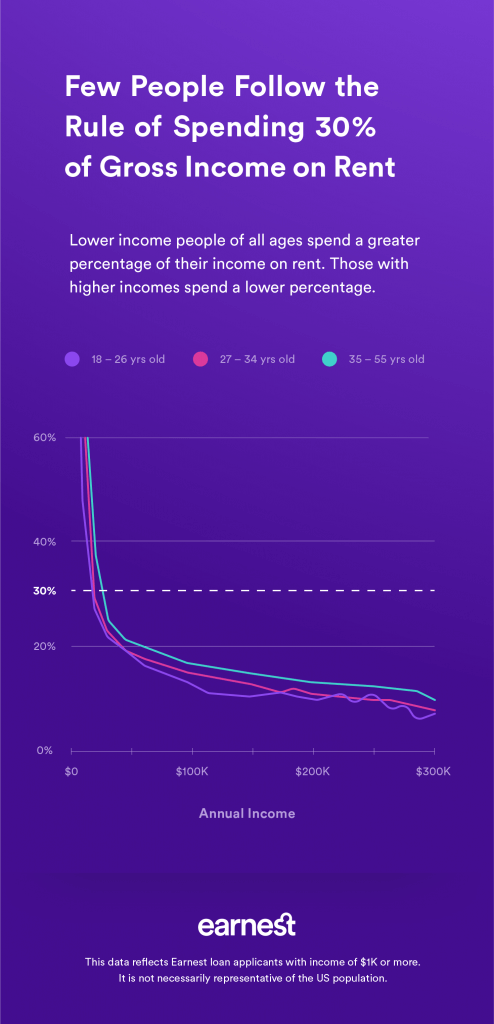

To accost the first question, Earnest took a look at our dataset of more than fifteen,000 student loan applicants.1 We institute that at salary levels below $xxx,000, spending above thirty% of gross income on housing is the norm. (This is supported by a recent Harvard report, which found that 45% of households who make $xxx,000-$45,000 accept rent costs above xxx%.)

At incomes above $30,000, however, Earnest applicants increasingly have lower monthly expenses than the benchmark — downwards to effectually 10% of their gross incomes for the wealthiest renters. This reflects the economical idea that a person's marginal propensity to consume by and large decreases with increasing income. In other words, if your income doubles, you lot'll likely commencement spending more, only not a total two times more than.

Among Hostage's loan applicants, people making around $30,000 happen to be following the 30% rule, simply generally, virtually people are paying much more or much less.

Should the '30 Percent Rule' Even Be a Dominion?

And then, should the 30 percent dominion fifty-fifty be a general rule at all? To answer that question, we turned to experts David Bieri, an associate professor of Urban Diplomacy at Virginia Tech, and Carrie Friedberg, a San Francisco based certified money coach.

The short respond: No. Hither are four reasons why.

1. The 30% Rule Is Outdated

The 30% rule has roots in 1969 public housing regulations, which capped public housing hire at 25% of a tenant's annual income (it inched upward to 30% in the early on 1980s). Rather than looking at what consumers should be spending on housing, however, the government selected the percentages considering that's what consumers were spending.

"This is what one did on average in the past, and every bit such [the benchmarks] get absorbed into public policy," says Bieri, who has written several papers on the subject.

Bieri sees two problems with making thirty% the de facto personal finance dominion for renters: Start, averages, by definition, practice not take into business relationship the huge variations of what individuals do. 2nd, the balance sail and financial obligations of today's consumers are vastly different than those of the 1960s on whom this rule is based. Americans back then, for instance, didn't contribute to 401(yard) plans or take loftier student debt.

two. The 30% Rule Ignores Your Full Financial Film

Permit's exercise some back-of-the-napkin calculations. Say you're making $xxx,000 per twelvemonth and have no household debt. According to the xxx% rule, you'd be able to spend $750 per month on rent, which would leave roughly $1,300 a calendar month for savings and expenses (or $325/week, or $46/24-hour interval), after taxes.

"Quick calculations: $30,000 / 12 months = $2,500 ten .three (xxx% dominion) = $750 per month on rent and $1,300 a month left over for other payments and savings."

Sounds neat — until you start subtracting pupil loan payments (income-based repayment plans typically cap them at 8-10%) and retirement savings (ideally ten-15%). All of this could decrease another 15-20%, without accounting for food, entertainment, transportation, child care, additional debt or other savings.

3. The 30% Rule Doesn't Brand Sense for High Earners Either

And if yous're making $300,000 per year? The 30% rule would prescribe spending $vii,500 a month on rent.

"Quick calculations: $300,000 / 12 months = $25,000 x .three (30% rule) = $7,500 per calendar month on rent and $13,000 a month left over for other payments and savings."

Friedberg says even high earners may take debt, child support, alimony, elder care or other substantial expenses — similar saving for retirement. And in the long run, paying 30% on rent may exist an irresponsible practice.

"High earning individuals with a passion for their job and a commitment to their location might consider making a ameliorate investment in [buying] a house, condo or an flat," says Friedberg.

four. The thirty% Dominion Doesn't Take Your Personal Situation Into Account

Last but not least, as Bieri pointed out, all renters' needs are not akin. Young, city-dwelling professionals with an active social life might not demand or desire more a conveniently located small-scale, 2 or iii room apartment they tin can share with roommates, for example. Contrast their upkeep to that of a immature family unit (who might have the same income as the professional person roommates) looking for space for children and willing to pay a premium to be nearly skilful schools.

Creating a Budget For Your Personal Financial Situation

So what's a improve rule of thumb? Instead of blindly following the 30% dominion, create a realistic upkeep specific to your life. "When you accept a thorough picture of your financial life, you tin can run various scenarios to determine how much you can beget to pay," says Friedberg. "There is no magic, 1-size-fits-all answer."

Creating a budget may audio daunting but it can be quite simple. Hither are 3 tips to follow:

Tip one – Brainstorm tracking all of your electric current expenses with an online tool.

Utilise sites similar Mint.com for costless or MoneyMinderOnline for a minor monthly or yearly fee. After tracking your expenses for a fleck, see how much is left over for housing and notice areas where you tin can cut back and relieve more.

Tip two – Save an Emergency Fund

For earners who are able to save, Bieri recommends using a unlike criterion altogether: the iii-calendar month emergency fund. Look at your cash flow and liquidity, he suggests, to calculate whether you lot take enough of an emergency account to comprehend three to six months' worth of rent and debt obligations if y'all were to lose your income. The math may be trickier, merely you'll have a much clearer sense of how much hire you can comfortably afford.

Tip 3 – Try The 50/30/twenty Budget

If y'all still like some guidelines similar the 30% rule provides, try the 50/xxx/20 monthly budget. Using this rule, calculate what your later on-tax income is. From there, use l% of your have-home pay for housing, utilities, groceries, transportation and other not-essentials that typically price the same month to month. Use 30% of your take-home pay on non-essentials, or "wants", like habiliment, dining out, and entertainment. Lastly, use 20% of your monthly income to save and make extra payments on your debt.

1.Information reflects applicants anile xviii-34 who applied for an Earnest loan with rents of $100 or more and incomes of $1,000 or more.

Conquer your student debt. Refinance now.

Get My Charge per unit

Disclaimer: This web log post provides personal finance educational information, and it is non intended to provide legal, financial, or tax advice.

pohlmanvalmostricay59.blogspot.com

Source: https://www.earnest.com/blog/rent-and-the-30-percent-rule/